Q1 Residential Transaction Volume Down by Half Y-O-Y, Market Expected to Recover Lost Ground in 2H

Upcoming Three Months Crucial to Recovery, Subject to Pandemic Control

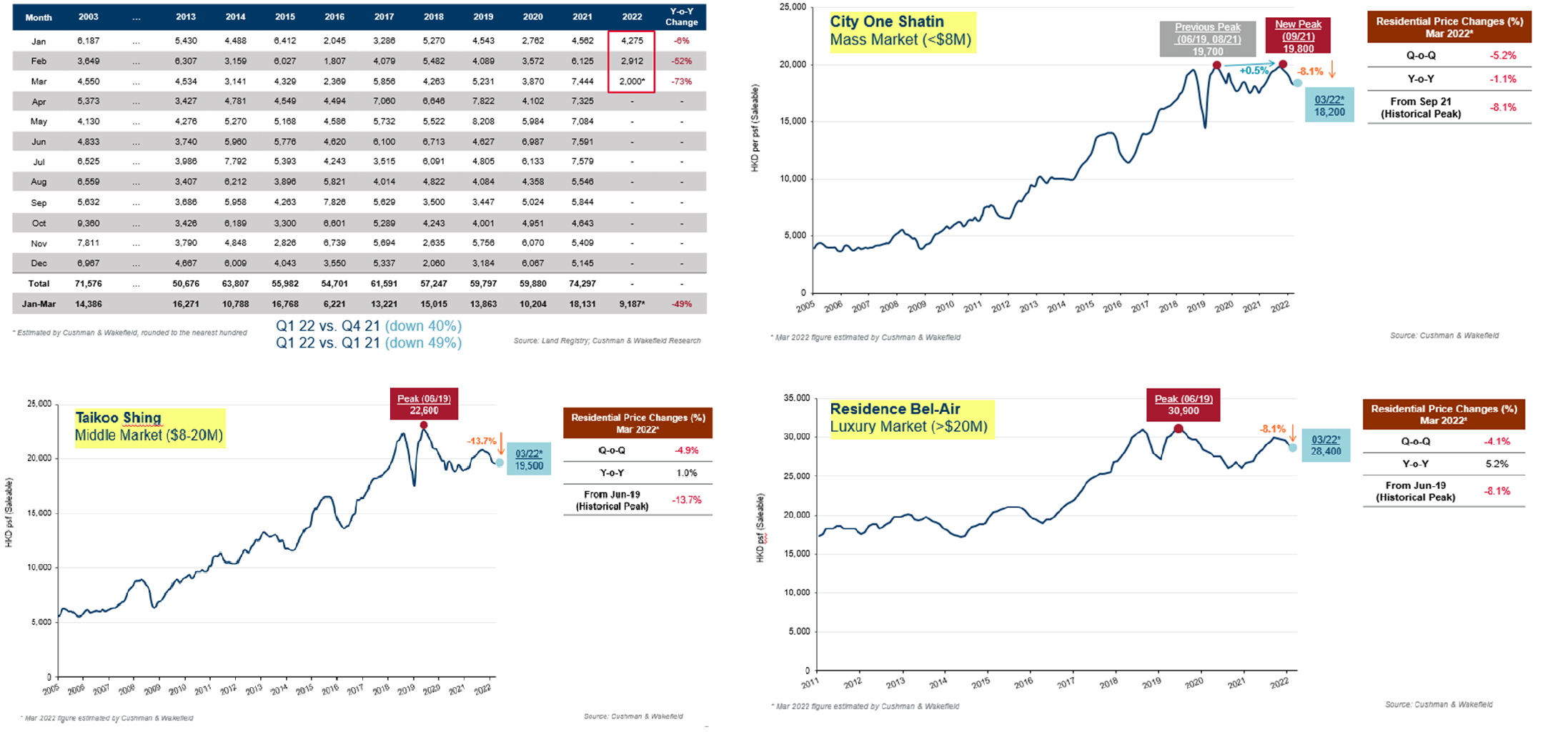

- Impacted by the fifth wave of COVID-19, and heightened geopolitical tensions, total residential transaction activity is now estimated at 9,187 deals, down 49% y-o-y

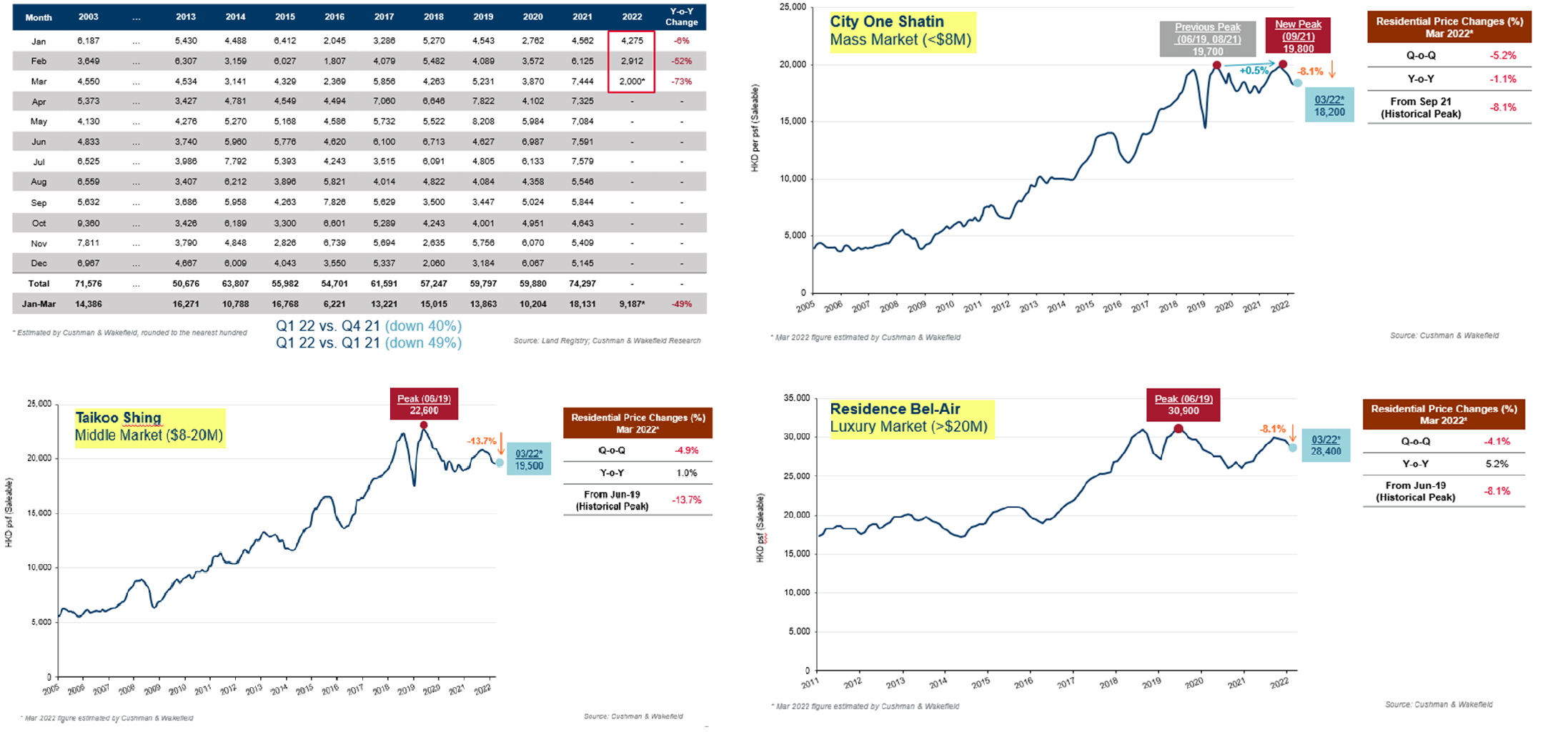

- Overall average home prices are expected to drop 5% q-o-q in Q1, with a milder fall in the luxury sector

- Assuming effective control of the pandemic in the next three months, the property market should regain momentum in 2H, with expected price growth of up to 3% y-o-y for 2022

HONG KONG SAR – Media OutReach – 10 March 2022 – Global real estate services firm Cushman & Wakefield announced its Q1 2022 Hong Kong Residential Market Review and Outlook report today. Impacted by the fifth wave of the pandemic, Hong Kong’s total residential transaction volume logged the lowest point since the 6,221 deals recorded in Q1 2016, while the overall average residential price is expected to fall by 5% q-o-q. However, despite the overall market being severely hit by the pandemic, end-user demand remains healthy. As the number of recorded positive COVID cases is now expected to start to decline, the recently proposed revision of the mortgage insurance programme and a potential reopening of the border will likely spur a market rebound.

Edgar Lai, Director, Valuation and Advisory, Hong Kong, Cushman & Wakefield shared: “The secondary market has been hit by the pandemic, with the overall price slipping by 2.2% from its peak in September 2021. Prices at City One Shatin, a proxy for the mass market, have decreased by 5.2% q-o-q (Chart 2). Similarly, prices at Taikoo Shing, a proxy of the middle market, dropped by 4.9% q-o-q (Chart 3). On the other hand, Residence Bel-Air, representing the luxury market, has shown greater resilience with a relatively milder fall of 4.1% q-o-q (Chart 4). Typically, luxury property owners have greater holding power and can contribute to relatively more stable prices.”

Commenting on the market outlook, Keith Chan highlighted: “Control of the pandemic in the next three months will be crucial to the domestic property market. If the pandemic is brought under control before mid-year, and the social distancing measures and border controls are gradually relaxed, the Financial Secretary’s recently announced relaxation measures in the mortgage insurance program policy will likely help the market recover, and will stimulate demand that was previously excluded from the program. With the aforementioned assumptions, the property market is expected to recover in the second half of the year. We expect it will be driven by first-hand properties, with gradual momentum growing into the second-hand market. Given the high base in 2021, the total transaction volume in 2022 is expected to drop by 15% to 18%. Overall average home prices will likely reach the bottom by 1H and start to recover by 2H, and we hold growth expectations at between 0% and 3% for 2022.”

Please click here to download photos.

Image 1

Left: Keith Chan, Director, Head of Research, Hong Kong, Cushman and Wakefield

Right: Edgar Lai, Director, Valuation and Advisory, Hong Kong, Cushman & Wakefield

About Cushman & Wakefield

Cushman & Wakefield (NYSE: CWK) is a leading global real estate services firm that delivers exceptional value for real estate occupiers and owners. Cushman & Wakefield is among the largest real estate services firms with approximately 50,000 employees in over 400 offices and 60 countries. Across Greater China, 22 offices are servicing the local market. The company won four of the top awards in the Euromoney Survey 2017, 2018 and 2020 in the categories of Overall, Agency Letting/Sales, Valuation and Research in China. In 2021, the firm had revenue of $9.4 billion across core services of property, facilities and project management, leasing, capital markets, valuation and other services. To learn more, visit

The issuer is solely responsible for the content of this announcement.

Recent Posts

VinFast Announces 1Q25 Global Deliveries and Date for the Release of First Quarter 2025 Results

HANOI, VIETNAM - Media OutReach Newswire - 28 April 2025 - VinFast Auto Ltd. ("VinFast"…

Galaxy Macau Launches “Timeless Flavors of Macau” in Tributes to Local Culinary Heritage

A Symphony of Authentic Macanese Flavors and Luxury Dining Experiences MACAU SAR - Media OutReach…

iFLYTEK Debuts On-Prem LLM All-in-One Solution at GITEX ASIA 2025

SINGAPORE - Media OutReach Newswire - 28 April 2025 - On April 23, at the…

Where Bricks Bloom: Pacific Place Unveils Hong Kong’s First LEGO® Botanical Garden

Step Into a Brick-Built Spring-Summer Wonderland Where Nature Blooms with Imagination HONG KONG SAR -…

L’Oréal Powers Up SkinCeuticals’ eShop Growth with Appier’s AI-Driven Advertising and Marketing Solutions

HONG KONG SAR - Media OutReach Newswire - 28 April 2025 - Appier, a leading…

Driving Mobile Growth: GSMA Advocates for Policy Reforms to Enhance Investment in MENA

Vodafone Egypt Partners with GSMA to Propel Mobile Investment and Policy Changes in MENA; New…