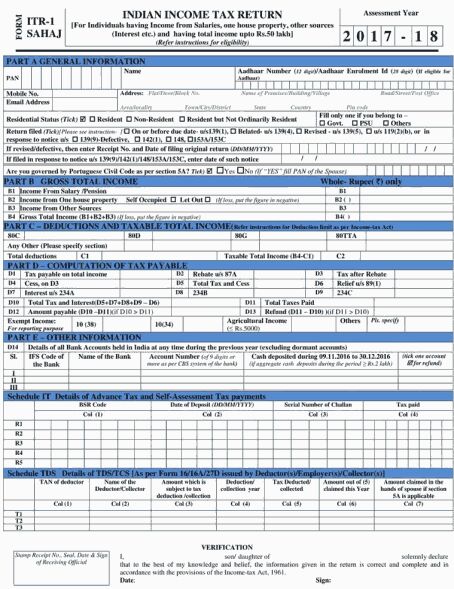

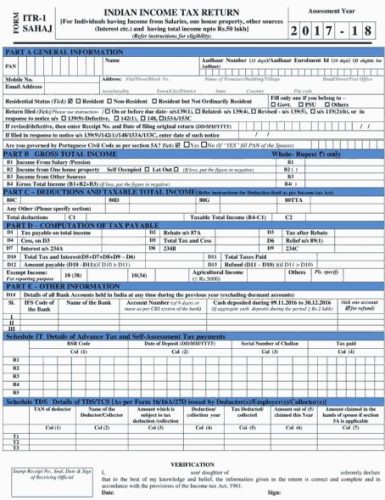

Income Tax Dept Simplified IT returns 2017-18

Centre has done well to increase the income limit for filing up from Rs 5 lakhs to 50 lakhs.

Cash deposits of over 2 lakhs in banks made during the de-mon period has to be declared.

E-filing facility is also likely to be introduced from April 1, with the deadline being stipulated till July 31.

And at the time of filing the form the taxpayer has to fill in his PAN, Aadhar number, personal information and information on Tax paid, plus, TDS will be auto filled in the form.

(Post July 1, it would become mandatory for the assessee to show his Aadhar card number or number showing that he has applied for the Aadhar card)

The e-filing website will also provide an an online calculator for to help individuals to determine their complete tax liability.

Recent Posts

Asia Pacific’s AI Ambitions Hinge on Next-Generation Networks, Reveals IDC Report

SINGAPORE - Media OutReach Newswire - 29 April 2025 – A new IDC InfoBrief* commissioned…

FBS Continues to Lead with Asia’s Best Mobile App and IB Program

SINGAPORE - Media OutReach Newswire - 29 April 2025 - FBS, a leading global broker,…

“Giant” Upgrade to Keung To Tram Fleet! “Keung Show HK Fan Club” Sponsors Free Tram Rides for All on April 30 Join us in celebrating Keung To’s 26th birthday

HONG KONG SAR - Media OutReach Newswire - 29 April 2025 - For the fourth…

SWAS Announces SESA AWARDS 2025 – 2026: Recognizing Excellence In Beauty & Wellness

SINGAPORE - Media OutReach Newswire - 29 April 2025 - The Specialists in Wellness Association…

UNDP and Trigger Team Up to Supercharge SDG Startups and Businesses with Smarter Investment and Support

SINGAPORE - Media OutReach Newswire - 29 April 2025 - The United Nations Development Programme…

Arrow Electronics Empowers Xeleqt with AIoT Technologies Adoption to Boost Workforce Productivity and Worksite Operations in the Philippines

MANILA, PHILIPPINES - Media OutReach Newswire - 29 April 2025 - Global technology solutions provider…