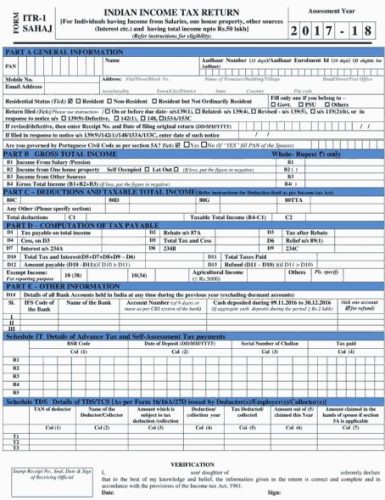

Centre has done well to increase the income limit for filing up from Rs 5 lakhs to 50 lakhs.

Cash deposits of over 2 lakhs in banks made during the de-mon period has to be declared.

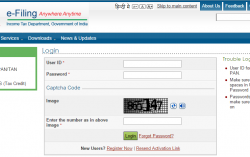

E-filing facility is also likely to be introduced from April 1, with the deadline being stipulated till July 31.

And at the time of filing the form the taxpayer has to fill in his PAN, Aadhar number, personal information and information on Tax paid, plus, TDS will be auto filled in the form.

(Post July 1, it would become mandatory for the assessee to show his Aadhar card number or number showing that he has applied for the Aadhar card)

The e-filing website will also provide an an online calculator for to help individuals to determine their complete tax liability.