Global Online Music Streaming Growth Slowed Down in Q2 2020

- Market continues to grow annually, but the growth rate dipped on a quarterly basis

SEOUL & HONG KONG & NEW DELHI & BEIJING & LONDON & BUENOS AIRES & SAN DIEGO–(BUSINESS WIRE)–Global online music streaming revenues declined 2% QoQ but grew 13% YoY in Q2 2020 at $6.7 billion, according to the latest Counterpoint Research findings. This is the first-ever QoQ decline in terms of revenues as music streaming has been gaining strength with every passing quarter. Paid subscriptions grew 29% YoY compared to 35% YoY in the Q1.

Research Analyst Abhilash Kumar said, �The growth slowed down in Q2 and, for the first time, the revenues declined sequentially. There are a couple of reasons for the same. The music streaming platforms offered discounts and lowered prices for paid subscriptions to retain consumers or to prevent them shifting to a free plan. Also, advertisement revenues saw a dip since many companies cut expenditure in view of COVID-19. However, podcasts related to different genres were able to keep people glued, offsetting some of the decline.

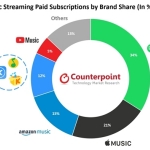

In terms of monthly active users (MAUs), Tencent Music (with its subsidiaries QQ Music, Kuwo and Kugou) led the chart in Q2 2020 with 26% share, followed by Spotify and YouTube Music with 12% and 10% shares, respectively. However, in terms of paid subscriptions, Spotify continued to lead with 34% share, followed by Apple Music (21%) and Amazon Music (15%).

Kumar added, The social media platform and free availability of music help Tencent Music maintain the No. 1 spot in terms of MAUs. For similar reasons, YouTube Music is also among the top three. Strong brand presence, attractive offerings, continuous product improvisation and focus on podcasts have helped Spotify. Apple Musics free six-month subscription offering in 52 countries helped maintain its share.

The music streaming industry was almost immune to the ill-effects of COVID-19 in Q1. In fact, the streaming hours increased as people stayed at home. Starting Q2, the market witnessed a slowdown in growth, driven by sequential decline in both paid and ad-based revenues. Starting June-end, the growth is slowly coming back on track. We believe the growth will be back to pre-COVID-19 levels by Q4 2020.

Our in-depth Global Online Music Streaming Market Tracker, Q2 2020 can be downloaded here.

Contacts

Abhilash Kumar

abhilash@counterpointresearch.com

Hanish Bhatia

hanish@counterpointresearch.com

Recent Posts

AIA Hong Kong continues to lead the insurance industry with 9 market No.1 in 2024

Number of New Business Policies tops the market for 11 consecutive years HONG KONG SAR…

Feng Wei Ju and 8½ Otto e Mezzo BOMBANA Garner Coveted Diamond Awards in Black Pearl Restaurant Guide 2025

MACAU SAR - Media OutReach Newswire - 25 April 2025 - 2025 Black Pearl Restaurant…

Creww and Real Madrid Next launch Batch 2 of “Real Madrid Next Accelerator for Asia”

TOKYO, JAPAN - Media OutReach Newswire - 25 April 2025 – Creww Inc. (Japan Office:…

Digital Storytelling: “Zhengzhou in Cultural Relics” Debuts with AR Reconstructions Global Premiere on International Day for Monuments and Sites

ZHENGZHOU, CHINA - Media OutReach Newswire - 25 April 2025 – On International Day for…

Chinese and foreign guests gather to talk about innovation and development of Museum in Liangzhu, Hangzhou

HANGZHOU, CHINA- Media OutReach Newswire - 25 April 2025 - From April 23 to 25,…

Hang Lung’s 65th Anniversary Celebrations Arrive at Shanghai Grand Gateway 66 and Plaza 66 Debut of “ButterBear” & Takashi Murakami’s Ohana Hatake Pop-up

Fuel double-digit growth in foot traffic and sale HONG KONG SAR and SHANGHAI, CHINA -…