EML Announces Record Revenues of $95.3M and EBITDA Of $28.1M

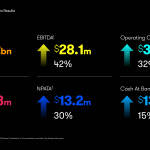

- Group Gross Debit Volume of $10.2 billion, up 54% over PCP;

- Group Revenue1 of $95.3 million, up 61% over PCP;

- Group EBITDA2 of $28.1 million, up 42% over PCP;

- Group NPATA of $13.2 million, up 30% over PCP;

- Underlying operating cash inflows of $35.1 million, up 68% on PCP; and

- FY21 Reinstated EBITDA Guidance Range of $50.0 million – $54.0 million.

BRISBANE, Australia–(BUSINESS WIRE)–EML Payments Limited (ASX: EML) is pleased to release its FY21 Interim Report, as attached to this announcement with its Appendix 4D.

Highlights for the six months ended 31 December 2020 include:

Gross Debit Volume (�GDV) of $10.2 billion, up 54% over PCP

GDV represents the debit volume processed by the Group through our proprietary processing platforms. The first six months of FY21 delivered a record result, with GDV growing 54% over the prior comparative period (PCP) to $10.2 billion. Whilst this volume translates to revenues at different rates depending on the segment, GDV is an indicator of demand for our payment services.

GDV from our General Purpose Reloadable (GPR) segment grew strongly, up 233% to finish on $4.87 billion. Despite lockdown and social distancing restrictions in key markets including Spain, France and the UK, Prepaid Financial Services (PFS) exceeded our expectations, contributing $3.12 billion in GDV, following strong performance in the digital banking and government sector. The GPR segment also saw solid growth in the non-PFS EML businesses which were up 25% on PCP on a like for like basis, driven by organic growth from programs in Salary Packaging (+60%) and Gaming (+42%).

Our Gift & Incentive (G&I) segment saw challenging trading conditions due to COVID-19-related mall closures, lockdowns and social distancing regulations, with GDV in the segment falling 11% to $0.75 billion, compared to $0.84 billion in H1 FY20. We experienced more stringent lockdown restrictions in key European and Canadian markets in the weeks immediately prior to the seasonal peak of December, resulting in a 19% decline in mall volumes relative to PCP. Despite this impact, incentive programs grew 11% on PCP, partially offsetting weaker mall volumes. Whilst impactful to our results in the short term, we expect the majority of the lost volume in the malls segment to be recovered in FY22 as economies re-open and lockdown restrictions are removed. We expect to see a continuation of growth in our Incentive vertical driven by new partners and programs in market.

In our Virtual Account Numbers (VANs) segment, GDV increased by 6% to $4.59 billion, driven by volume growth from existing customers. The December exit run rate finished on $815m per month, up 20% on the same month last year, which is a positive sign for the remainder of the year.

Revenue of $95.3 million, up 61% over PCP

The Group achieved record revenue of $95.3 million which is growth of 61% over the PCP. Revenue yield for the group is a function of segment mix and remained stable at 93bps (PCP: 89 bps) for the six months.

GPR revenue represented 57% of Group revenues in the first half, demonstrating the extent of the Groups pivot to deriving a majority of revenues from the GPR segment. The segment supports customers in multiple industry verticals, including digital banking, government and payroll programs which have proved resilient, but not immune to challenging macro-economic conditions. The GPR segment increased revenue by a significant 314% to $54.4 million, derived from both acquisition and organic sources. PFS generated $38.0 million in revenue, while the non-PFS contributed $16.4 million (up 25% on PCP) in revenue for the full six-month reporting period. The segment revenue yield was consistent since the acquisition of PFS in March 2020, at 112 bps, and up on PCP at 89bps.

Revenues in our G&I segment declined by 13%, or $5.2 million over the PCP, due to the reduction in GDV from mall gift cards. The impact of lower volumes on revenues were partly offset by an increase in breakage rates due to greater amounts unspent on gift cards sold in prior years. Overall, the G&I segment delivered $35.0 million or 37% of the Groups revenue. We remain conservative in our estimates and expect to see further benefits from residual gift card breakage in the second half of FY21. Revenue yield converted lower at 467bps (PCP: 479bps) with a mix shift towards greater volumes of lower-yielding Incentive programs.

The VANs segment increased revenue in line with GDV growth, to $5.8 million, up 5% on PCP. The VANs segment generated 6% of Group revenues but remains a strategically important vertical for us in terms of overall volumes and our relationships with the payment schemes. GDV converted to revenue at a revenue yield of 13 bps, consistent with the prior period.

Gross profit margins of 71%, down 5% over PCP

The Group generated a gross profit margin of 71%, down 5% on the PCP. Gross profit margins vary across the three segments. The reduction in Group gross profit margin is largely attributable to the segment mix shift toward GPR which was dilutive to the margins driven by outsourced processing costs and costs incurred using the Faster Payments network in the UK. These are the two synergy savings that were outlined in our acquisition case, and as these costs are removed, gross margins from PFS will increase, which will flow into the GPR segment and overall gross margin percentage.

As outlined in our investor presentation, we expect to complete the Faster Payments integration by the end of the financial year, saving approximately £480K in FY22 (A$850K), and we are continuing to set the foundations for saving the bulk of our outsourced processing costs by the end of FY23. These projects, all else being equal, would add back approximately 5% to percentage gross margins.

The G&I segment generated a gross profit margin of 82%, an increase on PCP (80%) with the segment benefiting from higher rates of breakage in North America tied to lower redemption rates. We will recognise $3.8 million of breakage revenue on gift cards loaded in the first half, but phased into the second half of the financial year under AASB15. The decline in carry forward breakage this year compared to PCP ($6.8 million) is due to lower unit sales in the two to three weeks immediately prior to Christmas.

Moving forward, we expect continued benefits to gross profit margins from reduced transaction costs, due to higher volumes, and PFS insourcing volumes from third party processing over the next 3 years.

EBITDA of $28.1 million, up 42% over PCP

Despite COVID-related challenges in our G&I segment, the Group achieved record EBITDA of $28.1 million for the half-year ended 31 December 2020 (PCP: $19.7 million). This is a significant result for a number of reasons, but principally it demonstrates that we have transitioned away from being a company reliant on seasonal mall gift card results, to a broader business where we generate a majority of revenues from the GPR segment.

In HY1 FY20, we generated approximately 70% of revenues from the G&I segment, and therefore any impact to that segment would have had a disproportionate impact on Group results. In H1 FY21, we generated 37% of revenue from the G&I segment, and that diversification has allowed us to post a record result despite some challenging market conditions.

Underlying Operating Cash Flow of $35.1 million and Cash on hand of $136.5 million

Statutory operating cash inflows totalled $34.8 million, which included $2.8 million of one-off accelerated breakage receipts under agreements with our Canadian sponsor banks, tax and interest outflows of $2.9 million and favourable working capital movements of $4.0 million. Underlying operating cash flows totalled $35.1 million or an EBITDA conversation rate of 125% (PCP: $13.1 million 66%).

Cash outflows from investing activities included $9.8 million for the minority investments connected with Project Accelerator, gaining us access to new technology and commercial opportunities. We continued to invest in software development, capitalising $4.8million of internally generated assets which will generate an economic return in future periods.

The Group has significant cash reserves and continues to generate strong operating cashflows which fully covers future operational needs and provides a platform for future investments.

EML ended the period with $136.5 million in cash and $29.1 million of breakage accruals (Contract Asset), of which 63% will convert to cash within 12 months. In FY21, investors will see an improvement in operating cash flow from the G&I segment as breakage on previously issued cards converts to cash but against a backdrop of lower unit sales (and therefore less accrued breakage revenue under AASB15. In FY22, as economies re-open, its likely that we would see higher unit sales, higher accrued breakage revenue and lower cash conversion.

Guidance range for FY21

The Groups guidance range for FY21 incorporates the uncertainty of COVID-19 as lockdown and social distancing measures remain in place for the foreseeable future in many of our key markets in Europe and North America.

Our EBITDA guidance reflects growth in absolute terms of approx. 60% for the full financial year and pleasingly maintains our track record of year-on-year EBITDA growth.

- Revenue forecasted between $180.0 million $190.0 million (up 48-56% on FY20)

- EBITDA forecasted between $50.0 million $54.0 million (up 54-66% on FY20)

- NPATA forecasted between $30.0 million $33.5 million (up 25-40% on FY20)

- EBITDA per share forecasted between 13.8¢ – 15.0¢ / share (up 54-66% on FY20)

Business Development Update

The Group continued to sign new contracts with customers in each segment and has seen increasing activity in new business contract wins and program launches.

In our GPR segment, we signed a remarkable 55 contracts, and in the G&I segment, we signed 19 contracts, largely with Incentive partners who will utilise our mobile PAYS technology. Incentive programs will be a key platform for growth in this segment whilst we wait for volume in our malls gift card programs to rebound, and its worth noting that in Australia, we managed 150 fully digital incentive programs, a number of which were in industries where doing a physical incentive card program would be impractical.

In the VANs segment, we signed 5 contracts and are working to launch these programs by the end of the financial year.

We also launched 64 programs in the market in the first half which are now contributing to revenue. One of these programs was the launch of a GPR payout card for Paddy Power in Europe and the migration of cards from a competitor to EML, which was completed in December 2020. We continued the migration of Smart Salary accounts to our platform and ended the half with 282,000 accounts active, which has since increased to 286,000 and we expect to be 300,000 by the end of the financial year. In the UK, we have launched Phase 1 of the program with the Home Office and launched the Jersey stimulus program, ending the half with 561 government programs in market.

Coinciding with our EMLCON2020 event, we announced the pilot with the NSW Department of Transport for their digital Opal card trial, and we look forward to updating shareholders on the progress of that pilot. These fully digital programs are fully aligned to our core strategy, Project Accelerator.

About EML Payments Limited

At EML, we develop tailored payment solutions for brands to make their customers lives simpler. Through next-generation technology, our portfolio of payment solutions offers innovative options for disbursement payouts, gifts, incentives and rewards. We’re proud to power many of the worlds top brands and expect to process over $18 billion in GDV in FY21 across 28 countries in Australia, Europe and North America. Our payment solutions in 27 currencies are safe and secure, easy and flexible, providing customers with their money in real-time. We know payments are complex, thats why we’ve made the process simple, smart and straightforward, for everyone.

We encourage you to learn more about EML Payments Limited, by visiting: https://www.emlpayments.com/

This announcement has been authorised for release by the Board of Directors.

1 Revenue is adjusted for the reduction of $1,033,000 of non-cash amortisation of the fair value uplift relating to the bond portfolio at the PFS acquisition date.

2 EML generates interest income on Stored Value balances and as such is a source of core revenue. Earnings Before Interest, Tax, Depreciation & Amortisation (EBITDA) is used as the most appropriate measure of assessing performance of the group. EBITDA includes R&D tax offset and excludes share-based payments, acquisition costs and foreign exchange gains or losses and is reconciled to statutory profit and loss within the FY21 Interim Report.

Contacts

Tom Cregan

Managing Director and Group Chief Executive Officer

EML Payments Limited

M: 0488 041 910

E: tcregan@emlpayments.com

Rob Shore

Group Chief Financial Officer

EML Payments Limited

M: 0419 590 128

E: rshore@emlpayments.com

Recent Posts

Schneider Electric advances in product environmental data transparency

Enabling customers to make better informed sustainability and business decisions 14 environmental data attributes now…

Galaxy Macau Celebrates 30 Years of China–Monaco Ties with the Spectacular ‘Galaxy Music Gala: A Musical Journey from Monaco to Macau’

MACAU SAR - Media OutReach Newswire - 30 April 2025 - In celebration of the…

Backbase launches world’s first AI-powered Banking Platform, putting banks back in Growth Mode

Industry pioneer redefines what a banking platform is in the era of AI, and delivers…

Vietnamese Student Exemplifies Growing Success of International Community at CUHK

HONG KONG SAR - Media OutReach Newswire - 30 April 2025 - The Chinese University…

Oryon.net Launches Oryon Academy: Empowering Microsoft 365 Business Users

Why Owning Microsoft 365 Isn't Enough Anymore — Oryon Academy Teaches Businesses to Master It…

Gold’s Path to $4,000: Macro Drivers, Market Sentiment, and Strategic Insight by global broker Octa

KUALA LUMPUR, MALAYSIA - Media OutReach Newswire - 30 April 2025 - Gold has kept…