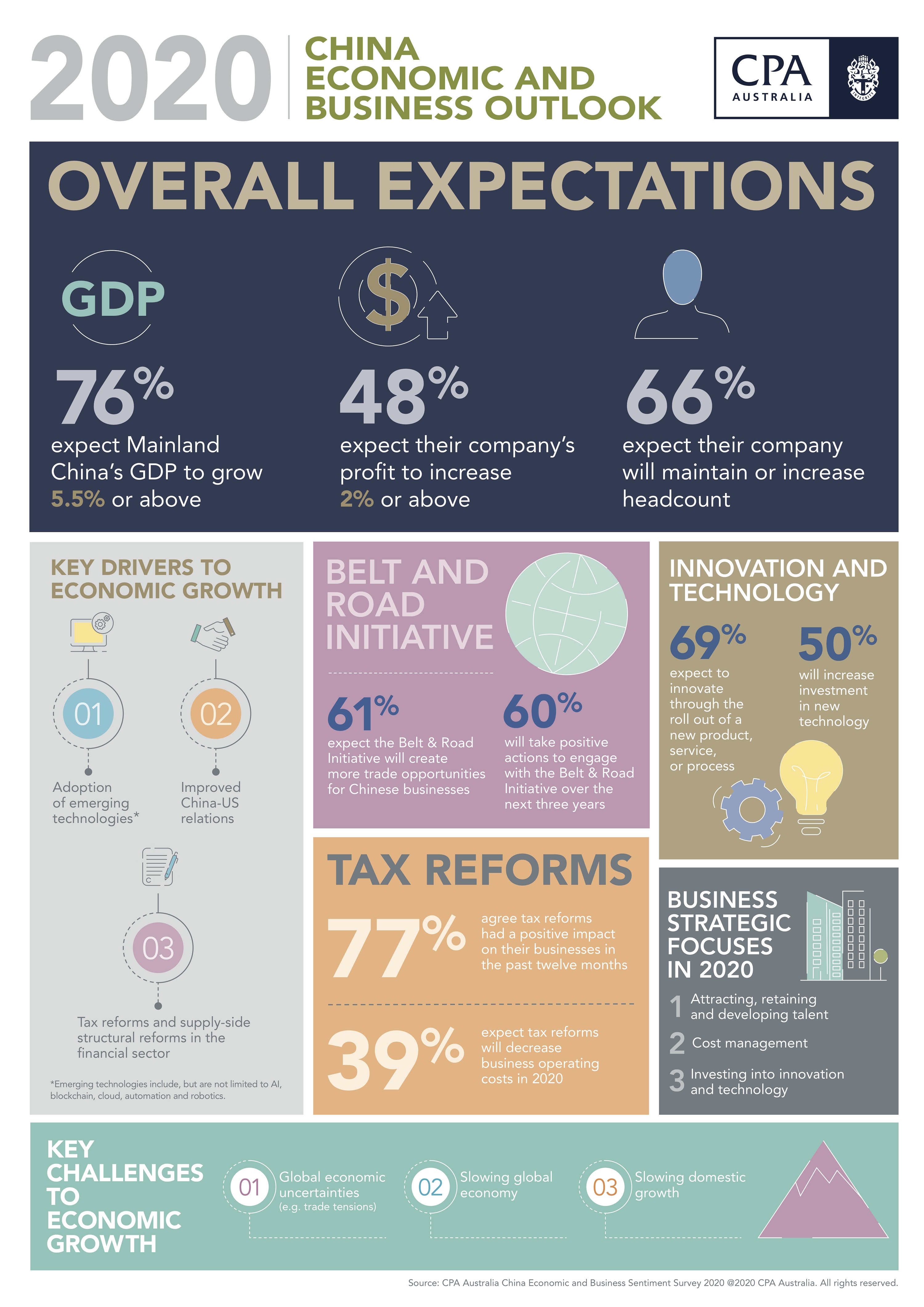

BEIJING, CHINA -�Media OutReach�-�17 January 2020 - Bolstered by the adoption of emerging technologies and the

government's tax and financial sector reforms, most accounting and finance

professionals expect China's economy to maintain a stable growth rate of above 5.5 per

cent in 2020. In addition, three-quarters expect their company's profit will

remain the same or increase, according

to the China Economic and Business Sentiment Survey 2020 conducted by CPA

Australia, one of the world's largest accounting bodies.

From left to right:�Mr. Kevin Ng Member of CPA Australia North China Committee , �Mr. Derek Chan President of CPA Australia North China Committee, Mr. Michael Yu President of CPA Australia East & Central China Committee and Mr. William Huang President of CPA Australia South China Committee

Stable and

high-quality economic growth

Despite short-term

headwinds, the survey findings show that accounting and finance professionals are

cautiously optimistic in China's economic conditions in 2020, with 76 per cent

of respondents forecasting GDP growth of 5.5 per cent or above.

The results

indicate that a combination of the adoption of emerging technologies and tax

and financial sector reforms are helping to boost the economy. Further , over one-third of respondents

believe improved China-US relations will also help to improve China's economy,

with the easing of trade tensions expected to improve confidence in trade and

investment, and make doing business easier.

A stable growth rate around 6 per cent in 2020 and high-quality growth

driven by investments in emerging technologies will see China remain a key

driver, if not the most important driver of global growth in 2020 and beyond.

Business resilience

Respondents are generally confident in China's business outlook for 2020,

with 75 per cent expecting that their company's profit will remain the same or

increase , of which 64 per cent believe that their company's profit will grow by

2 per cent or more. Consistent with robust profit expectations, respondents are

generally confident with in the labour market in 2020, with 66 per cent

expecting their company's headcount to remain the same or increase.

CPA Australia members were most likely to select

attracting,

retaining, and developing talent (27 per cent), followed by cost management (26

per cent), and investing into innovation and technology (25 per cent) as their

company's key strategic focuses for 2020. This reflects a proactive

short and long-term strategic focus of many Chinese firms.

Technology will

continue to boost economic growth

Supported by measures to encourage investment in research and

development, and adoption of emerging technologies, 42 per cent of respondents

chose the adoption of emerging technologies such as artificial intelligence,

blockchain technology, cloud computing, and robotic processing automation, as

the top driver of domestic economic growth in 2020. This indicates that many

accounting professionals are optimistic in the potential that these

technologies may provide to the economy, labour productivity and business

profitability.

The focus on innovation and technology by Chinese firms remains strong,

with 69 per cent of respondents expecting their business to introduce a new

product, service, or process in 2020, and half expect their business to

increase investment in new technology.

The focus on innovation and technology represents a long-term strategy

to continually move up the value chain. Targeted investments in innovation,

technology and talent by businesses should be them boost efficiency and stay

ahead of competitors.

Stimulating the

economy through tax financial structural reforms

The survey findings show that accounting and finance professionals

support policies to reform the financial sector and reform the tax system to

promote economic growth.

It therefore comes as no surprise that 77 per cent of respondents

indicated that tax reforms and reduced fees positively impacted their business

in 2019, with 53 per cent stating it has reduced their business tax burden.

91 per cent of accounting and finance professionals are confident that tax

reforms and fee reductions will provide a stimulus to the economy in 2020 through

decreasing business operating costs and further encouraging China's economic

transformation. The areas members would most like to see tax reforms in are

corporate income tax (67 per cent), individual income tax (65 per cent) and

value-added tax (55 per cent).

Seizing the

opportunities from the Belt and Road Initiative

The Belt and Road Initiative (BRI) is progressively

attracting more companies to engage in activities related to it, with 60 per

cent of respondents stating that their company will engage in BRI-related

activities over the next three years, up 5 percentage points from 2019.

6 1 per cent of respondents believe that the BRI will create more

trade and investment opportunities for Chinese businesses in 2020, suggesting

that accounting professionals are confident that the country's ambitious global

infrastructure and investment plan will help increase bilateral trade and

investment deals. � �

In

conclusion, businesses should take full advantage of the various strategies the

government has announced to lift productivity, lower operating costs, and

expand globally in 2020.

About the survey

The

survey was conducted from 20 November to 9 December 2019 with 242 of CPA

Australia's Greater China members participating, including finance and

accounting professionals from listed companies, multinational corporations,

private enterprise and the government.

About CPA Australia

CPA Australia is one

of the world's largest accounting bodies with more than 164,000 members working in 150 countries and regions

around the world, with more than 25,000 members working in senior leadership

positions. It has established a strong membership base of more than 19,000 in the Greater China region.