Positive results from Coeur�s largest and most successful drilling program helps to drive largest reserve base in Company history

CHICAGO–(BUSINESS WIRE)–Coeur Mining, Inc. (�Coeur� or the �Company�) (NYSE: CDE) today reported its 2020 mineral reserves and resources, and provided an update on its 2020 exploration programs at its Palmarejo and Kensington operations, following its mid-year update on August 11, 2020. Coeur also highlighted new drilling results at the recently-discovered C-Horst zone at the Crown exploration property in southern Nevada. The drilling campaigns at the Company�s Rochester and Silvertip mines as well as Crown and Sterling exploration properties were discussed during Coeur�s Investor Day on December 17, 2020.

Key Highlights1,2

- Positive results at Rochester and Palmarejo drove Companywide reserve growth � Successful drilling campaigns and resource conversions, net of depletion, drove strong double-digit reserve growth for both gold and silver at Rochester and Palmarejo. These positive results led to a 22% and 42% year-over-year increase in Companywide gold and silver reserves, respectively

- Significant increase in Silvertip�s resource base � Coeur significantly increased the size of its resource base at Silvertip, following the execution of the largest and most successful exploration program in the history of the property. Silver, zinc and lead measured and indicated resources increased by approximately 50%, 45% and 50%, respectively. Similarly, silver, zinc and lead inferred resources grew by approximately 46%, 69% and 37%, respectively

- Continued growth in measured and indicated resources � Measured and indicated resources were higher across all metals for the second consecutive year. Gold and silver measured and indicated resources increased 18% and 5%, respectively. The double-digit growth in measured and indicated gold resources was driven by significant additions at Palmarejo and Wharf, while slightly higher measured and indicated silver resources reflects additions at Palmarejo and Silvertip

- Expansion drilling at Palmarejo targeted new, high-grade discoveries � Expansion drilling north and west of the Independencia deposit returned positive results that highlight the potential for future reserve growth. Specifically, 90% of drill holes completed at the Hidalgo zone over the past two years returned intercepts above ore-grade cutoff over mineable widths. Importantly, the Hidalgo zone is adjacent to infrastructure and runs sub-parallel to the main haul road, trending towards the Palmarejo mill. Drilling into the zone has produced some of the highest grade-thickness intercepts recorded in the expansion program outside of the legacy Palmarejo mine. Drilling also successfully expanded the known extents of the principal Independencia deposit to the north. Notable results from the program include:

Hidalgo zone (Independencia deposit)

- Hole HGDH_032 returned 42.0 feet (12.8 meters) of 0.31 oz/t ounces per ton (�oz/t�) (10.8 grams per tonne (�g/t�)) gold and 12.4 oz/t (425.0 g/t) silver, and

- Hole HGDH_035 returned 10.2 feet (3.1 meters) of 0.59 oz/t (20.1 g/t) gold and 77.2 oz/t (2,646.9 g/t) silver

North Independencia (Independencia deposit)

- VIDH_156 returned 3.0 feet (0.9 meters) of 1.72 oz/t (59.0 g/t) gold and 17.5 oz/t (598.5 g/t) silver

- New potential high-grade growth areas outside existing mining area at Kensington � Drilling throughout 2020 was successful in expanding Eureka, Elmira, Johnson, Raven and Upper Kensington. All are located near existing infrastructure and represent new potential resource growth areas for the next three to five years. Key highlights include:

Eureka

- Hole EU20-2050-216-X03 returned 16.8 feet (5.1 meters) of 0.98 oz/t (33.7 g/t) gold

- Hole EU20-2050-216-X10 returned 7.3 feet (2.2 meters) of 1.41 oz/t (48.4 g/t) gold and 3.2 feet (1.0 meters) of 1.84 oz/t (63.1 g/t) gold

Elmira

- Hole EL20-0850-156-X15 returned 1.1 feet (0.3 meters) of 5.45 oz/t (186.9 g/t) gold

Northern Belle (hanging wall structure of Upper Kensington)

- NB20-1710-218-X02 returned 19.4 feet (5.9 meters) of 0.24 oz/t (8.1 g/t) gold, 6.0 feet (1.8 meters) of 0.42 oz/t (14.4 g/t) gold, and 1.1 feet (0.3 meters) of 2.01 oz/t (69.1 g/t) gold

- New results continue to highlight growth potential at C-Horst (Crown) � New significant assays were returned from the eastern and western edges of the recently-discovered C-horst zone at the Crown exploration property in southern Nevada. The positive results demonstrate vertical thickness of mineralization and the potential for additional growth with continued drilling. Notable assay results include:

- Hole CH20-021 returned 710.0 feet (216.4 meters) of 0.03 oz/t (0.9 g/t) gold

�2020 was the largest and most effective drilling campaign in the history of Coeur, and we plan to build on this momentum over the next few years,� said Hans J. Rasmussen, Coeur�s Senior Vice President of Exploration. �Results are just beginning to demonstrate the quality and potential of our assets with record-setting reserve growth at Rochester, significant additions at Palmarejo and Silvertip, new discoveries in southern Nevada as well as wider portions of mineralization found in upper Kensington. On the back of these excellent results, and with a larger budget in hand, the site teams are preparing for another aggressive year of aiming to continue growing reserves and resources from our inventory of drill-ready targets. We have already mobilized 21 drill rigs at our six sites with the goal of making 2021 even more successful than 2020.�

�We launched several aggressive drilling campaigns in 2020 in the pursuit of potential mine life extensions and high-return organic growth opportunities. Our efforts were successful on multiple fronts, as demonstrated by significant increases in reserves at Rochester and Palmarejo which led to the largest level of total reserves in our history,� said Mitchell J. Krebs, Coeur�s President and Chief Executive Officer. �Additionally, our results at Kensington, Silvertip and Crown were particularly encouraging, and represent future growth opportunities for the Company. Transitioning our focus to 2021, we will remain keenly focused on generating meaningful results by sustaining a higher-level of exploration investment. Our main objectives for the year include (i) further expanding the resource base at our existing operations, with specific emphasis on Crown and Silvertip, and (ii) pursuing new discoveries at Palmarejo and Kensington. Our ability to achieve these objectives will be an important catalyst to driving higher returns on invested capital, growing net asset value and generating long-term value at Coeur.�

For a complete table of all drill results, please refer to the following link: https://www.coeur.com/_resources/pdfs/2021-02-17-RR-Exploration-Update-Appendix-Final.pdf. Please see the �Cautionary Statements� section for additional information regarding drill results.

Year-End 2020 Proven and Probable Reserves

Year-end 2020 proven and probable reserves totaled 3.1 million ounces of gold, 259.5 million ounces of silver, 296.1 million pounds of zinc and 193.2 million pounds of lead. Gold and silver reserve increases in 2020 were largely driven by the replacement of depletion and successful conversions at both Rochester and Palmarejo. Zinc and lead reserves were relatively consistent year-over-year given the Company�s focus on near-mine resource expansion and larger step-out drilling at Silvertip.

Coeur increased its gold price assumption for year-end 2020 reserves from $1,350 per ounce to $1,400 per ounce. The Company�s reserve price assumption for silver, zinc and lead remained unchanged at $17.00 per ounce, $1.15 per pound and $0.95 per pound, respectively.

Year-End 2020 Measured and Indicated, and Inferred Resources

Measured and indicated resources totaled 3.1 million ounces of gold, 255.4 million ounces of silver, 442.1 million pounds of zinc and 216.5 million pounds of lead, reflecting a second consecutive year of increases across all metals. Solid measured and indicated resource growth was driven by additions from Palmarejo, Kensington and Silvertip.

Inferred resources were 2.8 million ounces of gold, 105.5 million ounces of silver, 308.7 million pounds of zinc and 143.9 million pounds of lead. Inferred gold and silver resources decreased modestly year-over-year largely due to successful conversions, partially offset by additions at Rochester, Kensington and Silvertip. Zinc and lead inferred resources significantly increased year-over-year due to successful expansion drilling at Silvertip.

The Company increased its gold price assumption for year-end 2020 resources from $1,500 per ounce to $1,600 per ounce. Coeur�s resource price assumption for silver and zinc remained consistent at $20.00 per ounce and $1.30 per pound, respectively, while its lead resource price assumption decreased from $1.05 per pound to $1.00 per pound.

Exploration Update1,2

The primary focus of Coeur�s 2020 exploration program was resource expansion and new discoveries, including prospective step-out drilling on certain targets designed to test known boundaries of existing mineralization. Drilling was active at six of the Company�s sites during the year with each program delivering positive results, including new discoveries at Palmarejo, Kensington and Crown.

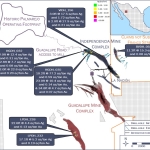

Palmarejo

Coeur�s exploration program at Palmarejo in 2020 reflected a relatively balanced approach of (i) larger step-out drilling to discover new mineralization, and (ii) infill drilling to convert existing resources, aimed at extending mine life. Up to seven rigs were active during the second half of 2020, focusing primarily on resource expansion targets.

A total of approximately 226,000 feet (68,850 meters) were drilled in 2020 from 180 drillholes (106 infill and 74 expansion) across 11 targets, compared to roughly 200,500 feet (61,075) in 2019 from 148 drillholes (85 infill and 63 expansion).

As discussed in Coeur�s mid-year 2020 exploration update, infill drilling during the first half of the year focused on the Guadalupe and Independencia deposits. During the second half of the year, infill drilling targeted the La Patria zone of the Guadalupe deposit and the La Bavisa zone of the Independencia deposit. Encouraging results from drilling in the second half of 2020 were reported from both zones.

Key highlights from infill drilling include:

La Patria zone (Guadalupe deposit)

- Hole LPDH_228 returning 22.6 feet (6.9 meters) of 0.13oz/t (4.3 g/t) gold and 4.4 oz/t (151.3 g/t) silver, and

- Hole LPDH_232 returning 17.1 feet (5.2 meters) of 0.19 oz/t (6.4 g/t) gold and 5.2 oz/t (178.7 g/t) silver

La Bavisa zone (Independencia deposit)

- Hole BVDH_055 returning 11.2 feet (3.4 meters) of 0.08 oz/t (2.8 g/t) gold and 15.3 oz/t (525.0 g/t) silver

The expansion drilling program focused on new zones and extensions of the Independencia deposit, specifically the northern extension of the principal Independencia structural zone, the Hidalgo zone (northwest) and the La Bavisa zone (northeast). Approximately two thirds of all drillholes from the 2020 expansion program cut mineralization above the current inferred resource grade (0.06 oz/t (2.2 g/t) gold and 3.3 oz/t (114.6 g/t) silver) over mineable widths.

Additional intercepts from the Hidalgo zone include:

- Hole VIDH_147 returning 22.3 feet (6.8 meters) of 0.28 oz/t (9.7 g/t) gold and 18.7 oz/t (639.9 g/t) silver,

- Hole HGDH_028 returning 36.7 feet (11.2 meters) of 0.18 oz/t (6.1 g/t) gold and 12.6 oz/t (430.7 g/t) silver, and

- Hole HGDH_037 returning 19.7 feet (6.0 meters) of 0.27 oz/t (9.1 g/t) gold and 16.6 oz/t (568.3 g/t) silver

Additional intercepts from the northern extension of the Independencia deposit include:

- Hole VIDH_154 returning 10.2 feet (3.1 meters) of 0.21 oz/t (7.3 g/t) gold and 10.4 oz/t (354.9 g/t) silver

The Company�s exploration team continues to refine its understanding of the geologic model for Palmarejo. Detailed surface mapping and sampling of several new targets generated by a project-wide, multi-variant prospectivity analysis have resulted in the definition of several new drill targets for testing in 2021.

Priority targets for the 2021 drilling program include: (i) expansion of the Hidalgo zone northwest towards the processing plant and haul road, and (ii) the extension of the north Independencia zone.

Additionally, two new targets for drill testing in 2021 include: (i) the Palmarejo North zone, strategically located to the north of the processing plant, and (ii) the El Ojito zone, located to the north and west of the Independencia deposit and subparallel to the Hidalgo zone.

Results from a high-density soil sampling program utilizing both geochemical and hyper-spectral data have confirmed that these technologies are suitable for use in areas of limited outcrop. With these new studies in hand, the soil sampling program is expected to be expanded in 2021, complementing the traditional surface mapping and sampling program. This target definition program is scheduled to continue throughout 2021, focusing on proximity to the main mine complex areas as well as new highly prospective targets across the more than 67,000-acre (27,000-hectare) land package.

The 2021 infill drilling program is expected to target resource conversion at the Independencia North and Hidalgo zones, the southwest extension of the principal Independencia deposit and the La Patria zone of the Guadalupe deposit. Coeur plans to prioritize infill drilling during the first half of the year, transitioning to expansion drilling during the second half of 2021.

All drill permits for the 2021 programs have been secured, and the Company plans to continue aggressively drilling resource expansion targets in high priority areas, with seven drill rigs currently at site and an eighth rig scheduled to arrive during the second quarter.

Kensington

The 2020 exploration program at Kensington built on the success of the 2019 drilling campaign, aiming to add higher-grade resources near existing mine infrastructure with the ultimate goal of extending Kensington�s mine life with new reserves. Up to four core rigs were active during the year drilling approximately 156,100 feet (47,575 meters) in 173 holes, compared to roughly 127,600 feet (38,925 meters) in 154 holes during 2019.

The Company�s top priorities for 2020 included: (i) underground expansion drilling at upper Kensington Zone 30, Eureka and Raven, (ii) surface expansion drilling of upper Raven and Johnson, (iii) step-out drilling at Big Lake, and (iv) infill and expansion drilling at Elmira and Johnson, respectively, from a new development drift established in the fourth quarter of 2020. Coeur successfully achieved all of its objectives for the year as highlighted in the graphic below:

Key highlights from the priority list described above included helicopter-supported surface drilling and underground drilling within the uppermost 2050-level of the Kensington mine. All of the zones drilled during the year appear to be getting wider in the upper portions of the structures, both from surface and from drilling underground on the 2050-level of the Kensington mine. New areas tested at higher-elevations included: (i) Johnson, where an additional 700 feet (225 meters) of strike length was tested from surface holes, and (ii) four new areas above existing infrastructure that were expanded, including upper Raven, Jennifer (near Raven), upper Kensington Zone 30, and Northern Belle (near the Kensington Main deposit).

Coeur expects to increase its exploration investment at Kensington during 2021, giving more priority to infill drilling and its resource conversion program, while also maintaining a similar focus on resource expansion drilling year-over-year. The Company began the year with two underground rigs targeting Elmira and Johnson. Both surface and underground drilling on Johnson identified discrete mineralization that Coeur expects to target in its expansion drilling program in 2021. Drilling at Elmira also regularly intercepted mineralized material in both the footwall and hanging wall situated near the center of the vein, highlighting continued opportunity for growth toward the southern portion of Elmira. Additionally, interpretation and modeling of the 2020 assay results from Elmira, Eureka, Johnson, Northern Belle and Raven drilling are currently underway. Once the results are interpreted, the Company plans to add a third underground core rig to continue expansion drilling on the highest priority, near mine, expansion targets.

Crown

Coeur�s 2020 drilling campaign at the Crown exploration property in southern Nevada was its most aggressive program at the site since acquiring the property in October 2018. After receiving assay results from the second hole at the C-Horst target in April 2020, the program accelerated to include two reverse circulation rigs and one core rig by the middle of the year. For the full year, a total of 85,600 feet (26,100 meters) in 72 holes were drilled, 48 of which were drilled at C-Horst (approximately 75% above resource grade thickness cutoff).

Crown also includes three other nearby deposits: (i) Daisy, (ii) Secret Pass, and (iii) SNA. All of the deposits are disseminated, oxide-gold resources hosted in Cambrian to Tertiary rocks, and are all located near one common structure, the Fluorspar Canyon Fault. The name came from the original fluorite mines in the area.

The same structure connects this area to the historic Bullfrog Gold Mine, which is located approximately ten miles (16 kilometers) to the west. A gravity geophysical survey led Coeur�s exploration team to test the new C-Horst zone. Once discovered, a revised combined geologic and geophysical interpretation of the entire Crown area suggested that the Fluorspar Canyon Fault cuts east-west through Daisy and Secret Pass, then bends to the north at SNA and cuts the west side of the C-Horst zone. This interpretation was only possible with the gravity data given that there was no surface exposure of the Fluorspar Canyon Fault except in the historic Secret Pass open pit.

For 2021, Coeur�s Beatty, Nevada-based exploration team is focusing on updates to the new geologic model (graphic on the right) and the first internal resource model to guide future exploration activities at C-Horst. Additionally, the Company expects to conduct step-out drilling in the first half of the year, targeting areas north of SNA and south of C-Horst in an effort to tie together regional mineralized faults that were mapped during 2020. Based on the current geologic interpretation, these faults are thought to link SNA and C-Horst, along the eastern side of the Crown Block.

Coeur began 2021 with four drill rigs, three reverse circulation and one core. With the largest exploration budget in the project�s history, all four rigs are expected to remain active during the year, conducting metallurgical core drilling and resource expansion drilling in and around all four resources areas at Crown (i.e., Daisy, Secret Pass, SNA and C-Horst).

About Coeur

Coeur Mining, Inc. is a U.S.-based, well-diversified, growing precious metals producer with five wholly-owned operations: the Palmarejo gold-silver complex in Mexico, the Rochester silver-gold mine in Nevada, the Kensington gold mine in Alaska, the Wharf gold mine in South Dakota, and the Silvertip silver-zinc-lead mine in British Columbia. In addition, the Company has interests in several precious metals exploration projects throughout North America.

Cautionary Statements

This news release contains forward-looking statements within the meaning of securities legislation in the United States and Canada, including statements regarding exploration efforts and plans, exploration expenditures, timing of permitting, drill results, growth, extended mine lives, grade, thickness, investments, mine expansion and development plans, and resource delineation, expansion, and upgrade or conversion. Such forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause Coeur�s actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others, the risk that anticipated additions or upgrades to reserves and resources are not attained, the risk that planned drilling programs may be curtailed or canceled due to budget constraints or other reasons, the risks and hazards inherent in the mining business (including risks inherent in developing large-scale mining projects, environmental hazards, industrial accidents, weather or geologically related conditions), changes in the market prices of gold, silver, zinc and lead and a sustained lower price environment, the uncertainties inherent in Coeur�s production, exploratory and developmental activities, including risks relating to permitting and regulatory delays (including the impact of government shutdowns), ground conditions, grade variability, any future labor disputes or work stoppages, the uncertainties inherent in the estimation of mineral reserves, the potential effects of the COVID-19 pandemic, including impacts to the availability of our workforce, continued access to financing sources, government orders that may require temporary suspension of operations at one or more of our sites and effects on our suppliers or the refiners and smelters to whom the Company markets its production, changes that could result from Coeur�s future acquisition of new mining properties or businesses, the loss of any third-party smelter to which Coeur markets its production, the effects of environmental and other governmental regulations, the risks inherent in the ownership or operation of or investment in mining properties or businesses in foreign countries, Coeur�s ability to raise additional financing necessary to conduct its business, make payments or refinance its debt, as well as other uncertainties and risk factors set out in filings made from time to time with the United States Securities and Exchange Commission, and the Canadian securities regulators, including, without limitation, Coeur�s most recent report on Form 10-K. Actual results, developments and timetables could vary significantly from the estimates presented. Readers are cautioned not to put undue reliance on forward-looking statements. Coeur disclaims any intent or obligation to update publicly such forward-looking statements, whether as a result of new information, future events or otherwise. Additionally, Coeur undertakes no obligation to comment on analyses, expectations or statements made by third parties in respect of Coeur, its financial or operating results or its securities.

Christopher Pascoe, Coeur�s Director, Technical Services and a qualified person under Canadian National Instrument 43-101, approved the scientific and technical information concerning Coeur�s mineral projects in this news release. For a description of the key assumptions, parameters and methods used to estimate mineral reserves and resources, as well as data verification procedures and a general discussion of the extent to which the estimates may be affected by any known environmental, permitting, legal, title, taxation, socio-political, marketing or other

Contacts

For Additional Information

Coeur Mining, Inc.

104 S. Michigan Avenue, Suite 900

Chicago, Illinois 60603

Attention: Paul DePartout, Director, Investor Relations

Phone: (312) 489-5800

www.coeur.com